How Your Property Taxes Could Contribute to a Mortgage Escrow Shortage

Here’s what you need to know about preventing, managing, and resolving a mortgage escrow shortage:

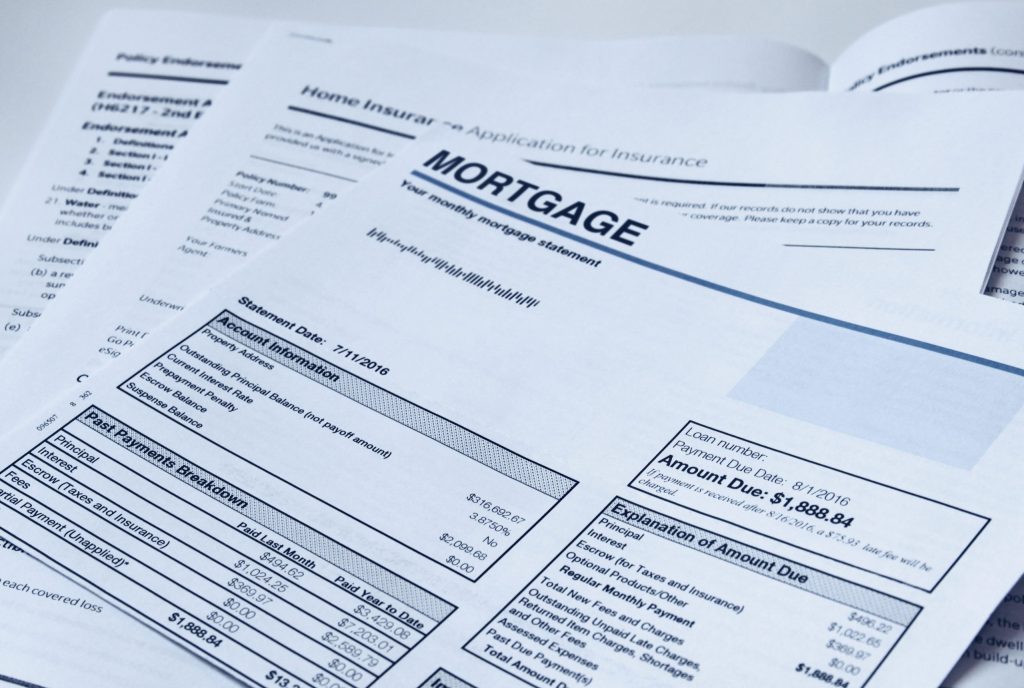

- When you make your monthly mortgage payment, part of your payment may include a contribution to an escrow account that pays for your property taxes and insurance expenses on your behalf.

- A mortgage escrow shortage happens when there isn’t enough money in your escrow account for property taxes and insurance payments.

- Changing tax rates and property tax appraisal values can lead to higher tax payments, which can lead to escrow shortages.

- Prevent a shortage by reviewing your annual escrow analysis with your lender and staying informed about increases in property tax and insurance expenses. You may also protest your property taxes to lower your tax burden.

- Work with a reputable lender, such as Beacon Lending, to help manage and resolve an existing escrow shortage.

What Is a Mortgage Escrow?

When you make the monthly payment to your mortgage company, you may also be making a monthly contribution to an escrow account which pays for your property taxes and insurance. The mortgage company essentially collects money from you throughout the year, holds the funds on your behalf, and pays your annual property tax and insurance bills for you. The escrow process helps many property owners smooth out and manage their expenses on a monthly basis rather than paying these large expenses in annual lump sums.

What Is a Mortgage Escrow Shortage?

A mortgage escrow shortage occurs when there isn’t enough money in your escrow account to cover property taxes and insurance. This can happen when your property taxes increase or insurance premiums go up, which takes more money than planned out of escrow. The last thing you want is to be late or fall behind on these payments, as the consequences can include expensive fees or potential foreclosure. While that may not happen after one or two months, it can catch up to you if you aren’t proactive.

Your Property Taxes & Escrow Funds

Property values are typically assessed annually by the County Appraisal District (CAD), which affects your annual property tax bill. They may increase, decrease, or remain the same from the previous year, depending on the local economy and housing market. Your property taxes are also affected by changing property tax rates based on the funding needs of local jurisdictions to maintain schools, infrastructure, and more. As we mentioned, when your property taxes rise, your escrow account may fall short, and you may need to make up for a shortage.

Something to note is that mortgage companies underwrite your property tax escrow with the information known at the time. For example, when you’re buying a home with a suppressed taxable value due to the exemption of the current owner. You may see a property tax increase after December 31st once the exemptions are removed and your home is reassessed. This can lead to a sudden increase in your escrow payment. For personal budgeting, we advise our clients who are buying a property to expect to pay property taxes on at least their purchase price multiplied by the current tax rate rather than basing the taxes off the first year’s estimated tax at closing.

How Can I Prevent a Shortage?

There are steps you can take to help prevent or catch a mortgage escrow shortage early. Check in with your lender and review your annual escrow analysis to preemptively adjust your escrow balance. Stay up-to-date on property tax (and insurance) increases so you know when they’re coming. Look on the county tax assessor’s website and your insurance carrier’s website to check for rate changes. You can also achieve significant savings by protesting your property taxes when you think you’re being taxed unfairly.

Many CADs assess property values using mass appraisal methods, which can rely on outdated or incorrect data and lead to overinflated property tax bills. They don’t visit every property in person, so certain aspects affecting your property’s taxable value can be missed. At Gill, Denson & Company, we’re experts at navigating the Texas property tax system. We can help you identify potential errors and present a compelling case to lower your tax burden. Protesting annually helps ensure you stay on top of tax increases and reduces the risk of an escrow shortage.

What If I Already Have a Mortgage Escrow Shortage?

Once you know you have a mortgage escrow shortage, there are further steps you can take to manage and resolve it. You can make lump-sum payments, monthly installments, or some combination of these two options. It’s best to speak with your lender about your specific situation and the best option to take. Learn more about how to prevent, manage, and resolve a mortgage escrow shortage at Beacon Lending, a lending company with over 20 years of experience in mortgage financing.

If you suspect an inaccurate property tax valuation, don’t hesitate to reach out to us. Get started with Gill, Denson, & Company today, and make sure you’re only paying your fair share of the tax burden!