Business Personal Property (BPP)

Tax Services

Our team of tax specialists will help reduce your business personal property (BPP) tax expense.

We will handle the entire process from filing timely renditions to ensuring correct asset valuations.

Our Services

1. Research & Analysis

Our team will analyze the client’s business personal property to determine the best strategy to obtain the lowest allowable tax assessment, which includes performing a fair market valuation of assets using third party appraisal data.

2. Rendition Filing

Our experienced tax consultants will timely file all required renditions and associated paperwork to ensure your business maximizes property tax savings and is in compliance with applicable tax laws.

3. Assessment Confirmation

We confirm that the local tax jusridiction assesses our client’s business personal property at the correct values. If there are any discrepancies, we will file a value protest to ensure value alignment.

Industry Specialties

We help clients in a variety of industries lower their business personal property (BPP) taxes all across the State of Texas.

Energy

Trucking

Aviation

Medical

Hospitality

Retail

Manufacturing

Case Studies

Check out real examples of our work in action. These are case studies featuring just a few of our recent property tax reductions.

The Gill, Denson & Company Difference

Types of Business Personal Property

Business Inventory

We ensure you obtain all applicable exemptions for your inventory such as the goods-in-transit exemption or the freeport exemption.

Vehicles

We ensure your vehicles maximize allocation schedules between taxing jurisdictions and are rendered at fair market value rather than depreciated cost, often results in significant savings.

Computers and Servers

We ensure you are only being taxed on the tangible value of your computers and servers, separating software and business value from your assessment.

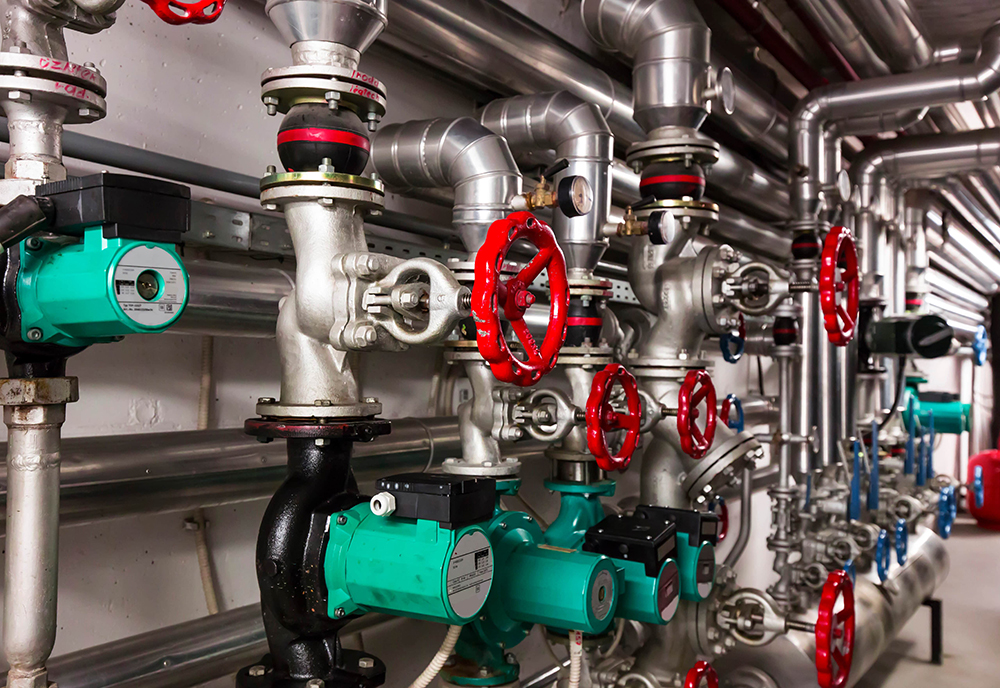

Equipment & Machinery

We perform a fair market valuation of your equipment & machinery to obtain the lowest allowable tax assessment, rather than accepting the often-inflated appraisal district values.

FAQ

Request Pricing

"*" indicates required fields