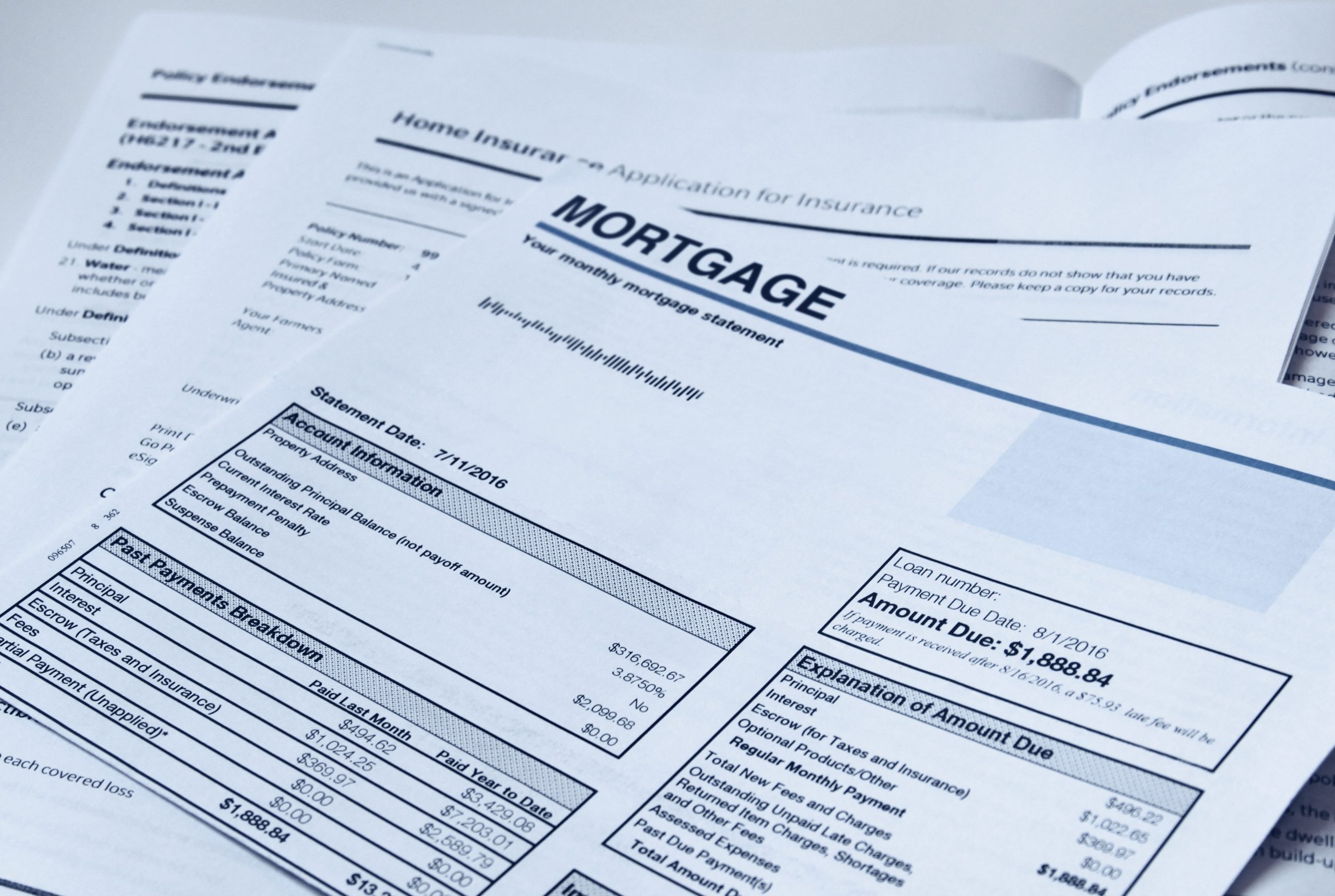

When Should You Protest Property Taxes in Texas? Follow This Timeline!

Nicole Schnell2025-02-13T23:18:25+00:00Here’s what you need to know about the best time to protest property taxes in Texas: Spring is when tax value notices are mailed, rendition filings are due, and the protest deadline occurs. Summer to fall is when protest hearings are typically held. Fall is when tax bills for the current year are mailed [...]